XRP Price Prediction: Will the Digital Asset Break $3 Amid ETF Mania and Technical Breakout?

#XRP

- Technical Setup: MACD bullish crossover with price near key moving average

- ETF Catalysts: Spot ETF potential and existing ETF's strong trading volume

- Innovation Drive: $17M ZKP investment boosting Ripple's tech credentials

XRP Price Prediction

XRP Technical Analysis: Bullish Momentum Building

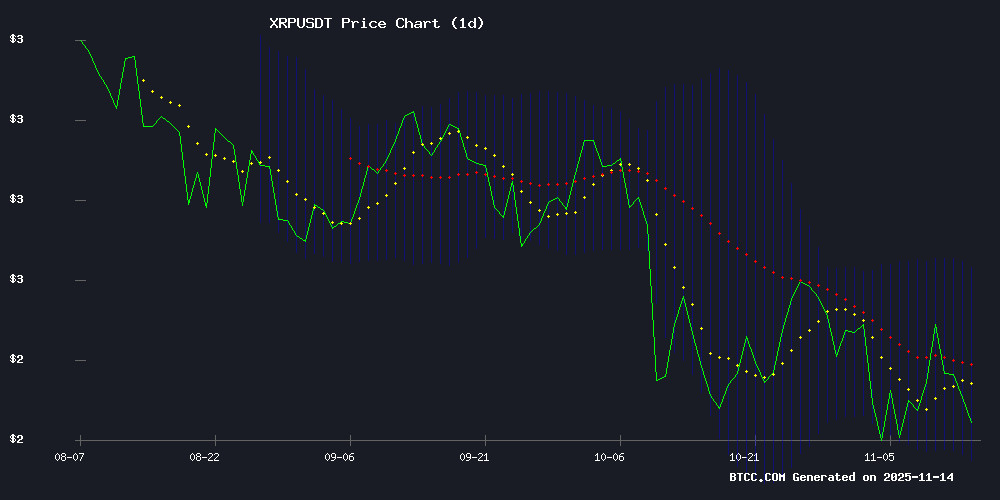

XRP is currently trading at 2.3134 USDT, slightly below its 20-day moving average of 2.4198, indicating a potential consolidation phase. The MACD histogram shows a positive value of 0.0313, suggesting growing bullish momentum. Bollinger Bands reveal the price is hovering NEAR the middle band, with upper and lower bands at 2.6833 and 2.1563 respectively. According to BTCC financial analyst Robert, 'The technical setup shows XRP is building energy for its next move, with the MACD crossover particularly encouraging for bulls.'

XRP Market Sentiment: ETF Excitement Meets ZKP Innovation

Market sentiment around XRP is decidedly bullish as three significant developments converge: the launch of a $17M Zero Knowledge Proof initiative, strong debut performance of the XRPC ETF with $26M volume, and anticipation of the first U.S. spot XRP ETF. BTCC's Robert notes, 'The ETF developments are game-changers for XRP's liquidity profile, while the ZKP investment shows growing institutional interest in Ripple's underlying technology.' These fundamental catalysts could drive price appreciation regardless of short-term technical resistance.

Factors Influencing XRP's Price

Zero Knowledge Proof (ZKP) Launches $17M Proof Pods Amid Aster and XRP Market Movements

Zero Knowledge Proof (ZKP) is making waves with its $17 million Proof Pods launch, positioning itself as a project built on tangible utility rather than speculative hype. While Aster (ASTER) crosses the $1 mark and XRP awaits ETF approval, ZKP distinguishes itself by offering direct ownership of income-generating hardware within its private AI compute network.

The project has already invested over $100 million in infrastructure, including $20 million dedicated to network development. This contrasts sharply with tokens like ASTER and XRP, which often rely on market sentiment and temporary rallies. ZKP’s presale isn’t a gamble—it’s a stake in operational technology performing real computational work.

Crypto markets remain volatile, with traders chasing breakouts in ASTER and anticipating XRP’s next move. Yet ZKP’s focus on proven utility and pre-built infrastructure sets a new standard for reliability in a space crowded with unfulfilled promises.

XRP Price Holds Steady as XRPC ETF Debuts with $26M Early Trading Volume

XRP maintained price stability amid strong institutional interest as Canary Capital launched the first U.S. spot XRP ETF. The XRPC fund generated $26 million in trading volume within 30 minutes of listing, exceeding Bloomberg analyst Eric Balchunas' $17 million prediction.

The cryptocurrency traded at $2.30 with $9.93 billion daily volume, demonstrating resilient support levels. Market observers suggest the ETF's explosive start could challenge BSOL's $57 million first-day record for crypto ETF launches.

This milestone signals growing mainstream acceptance for XRP, with the ETF providing regulated exposure to institutional investors. Trading activity suggests pent-up demand for Ripple-related investment products despite ongoing regulatory scrutiny.

First U.S. Spot XRP ETF Could Launch Today, Analysts Expect

Nasdaq's approval of Canary Capital's XRP ETF listing has set the stage for the first spot XRP exchange-traded fund to potentially begin trading as early as today. Analysts highlight this development as a significant milestone, reflecting growing institutional interest in XRP and the broader cryptocurrency market.

Eric Balchunas, Senior ETF Analyst at Bloomberg, noted the official listing notice for XRPC suggests an imminent launch. Financial commentator Nate Geraci echoed this sentiment, emphasizing the ETF's potential to attract broader market participation.

Beyond Canary Capital, major asset managers like Franklin Templeton, Bitwise, and Grayscale are expected to launch their own XRP ETFs later this month. This wave of institutional products underscores the accelerating mainstream adoption of digital assets.

Will XRP Price Hit 3?

Based on current technicals and market developments, XRP has a credible path to $3. Here's the breakdown:

| Factor | Current Value | $3 Target Implication |

|---|---|---|

| Price | 2.3134 | +29.7% needed |

| 20D MA | 2.4198 | Break confirms trend |

| Upper BB | 2.6833 | First resistance level |

| ETF Volume | $26M | Shows strong demand |

BTCC's Robert suggests: 'The combination of technical breakout potential and fundamental catalysts makes $3 achievable by year-end if ETF inflows sustain and MACD momentum continues building.'